ANALYTICS SERVICES

Home » Analytic Services

Analytic Services

Speed, Insight and Confidence

Advantage tax equity financing solutions involve a combination of Analytic Services, Project Finance Training and Modeling Technology tailored to meet client-specific needs.

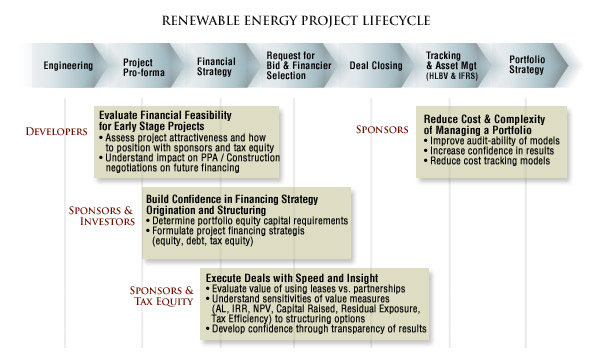

Analytic Services are provided to support nearly all the stages of a project’s lifecycle (see exhibit below) with a focus on term financing. Our services provide dealstructures and analytic insights in a fraction of the time of anyone else in the industry with far fewer resources required. We assess a broad range of innovative structuring options to identify feasible structures and increase returns. We help clients improve overall portfolio performance by addressing the entire portfolio rather than focusing solely on the project. We also support our clients with tracking and accounting to simplify back office efforts post close.

Examples of Analytic Services include:

• Evaluating Project Financial Feasibility

• Formulating Portfolio / Project Financing Strategies

• Executing Deals

• Tracking & Accounting for Deals

Evaluating Project Financial Feasibility (how much capital can be raised for a project)

Early in a project’s life, it is critical to understand if a project will be attractive to investors for term financing before expending significant effort and expense. Advantage can quickly evaluate a project’s ability to raise capital and meet tax equity financing requirements.

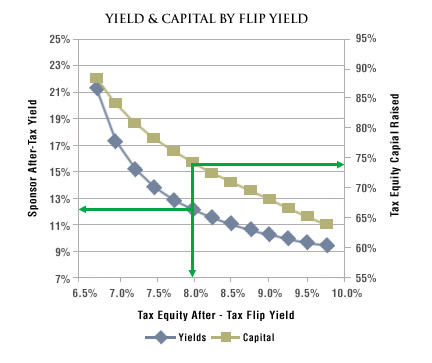

For a given project, the figure below shows a sample analysis Advantage can perform illustrating a Sponsor’s after-tax yield and capital raised for a range of tax equity after-tax flip yields. For example, the green arrows indicate that the project pro forma will raise approximately 75% of the project cost and generate a 12% after-tax yield for the Sponsor with a targeted 8% after-tax yield for the Tax Equity investor.

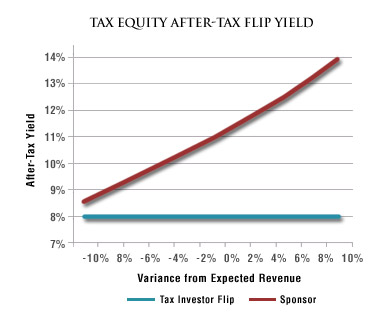

The figure below further illustrates how Advantage may assist a client by reviewing the impact on yield of expected and downside production scenarios (e.g., Sponsor After-tax Yield will range from approximately 8.5% to 14.0% given a revenue variance of ± 10%).

Formulating Portfolio / Project Financing Strategies

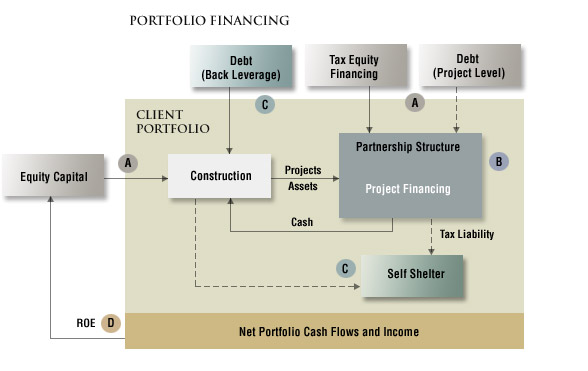

Advantage assists in formulating financing strategies at the project and portfolio level. Analytic solutions leverage the Advantage Technology which generates financial indicators at both the holding company and project-level. It also supports integrating updated actual and projected cashflow, taxable income and book earnings schedules. These data-driven perspectives inform a critical portfolio-level view. This supports decisions on prospective financings, project-level restructuring, and portfolio-level refinancing.

Strategies can address a number of questions, typically around four key areas:

• Funding Sources

• Project Finance Structures

• Financing Milestones

• Portfolio Returns

A. Funding Sources

Advantage can assist in:

• Quantifying how much equity capital (e.g., VC investment) is required for a business to become sustainable.

• Determining viable capital structuring options at the portfolio and project level (e.g., Equity capital, Tax equity, Project level debt, Back leverage debt, Cash Grant).

• Clarifying how much term funding (e.g., tax equity, debt) can a project raise.

B. Project Finance Structure

Advantage will shed light on:

• What structure, partnership or lease, best meets Client’s financial objectives.

• How much value (e.g., IRR, NPV, Capital Raised, Exposure) does a project / portfolio generate.

C. Financing Milestones

Advantage will assist you in determining:

• At what point project construction can be supported by cash flow generated from the partnership. Cash flow could be used to make direct investments without equity capital and also support balance sheet debt financing.

• At what point a tax liability from partnership interests allows self-sheltering for projects.

• When liquidation / partial liquidation of partnership assets make sense.

• What adjustments to timing for financing construction increase value for the portfolio.

D. Portfolio Returns

Advantage will clarify:

• What cash flows and income the portfolio generates.

• What returns will be generated for equity investors.

Executing Deals

Advantage provides a range of advisory services (i.e., modeling, analytics / interpretation, guidance) to get a project through the financing process. Advantage prepares its Clients to seek term financing, evaluates bids from prospective financiers, iterates structures and terms with financiers, and supports closeing financing. A key aspect of Advantage services is the depth of insight that is delivered in a fraction of the time of other service providers. Advantage case studies and white papers showcase Advantage’s ability to review a large number of possible deal structures and identify viable scenarios meeting multiple parties objectives. Our ongoing research and enhancements offer clients state-of-the-art structures. Advantage resources were instrumental in developing the 467 Rent Structures in 2000 and the PAP structure in 2003. Advantage continues to be at the cutting edge of innovation and insight.

Tracking and Accounting for Deals

Post close, Advantage provides tracking and accounting services to support reporting and compliance. Tracking and Accounting solutions leverage the Advantage Technology that enable tracking of actuals and calculation of earnings using HLBV and IFRS methods.