FINANCE TRAINING

Home » Finance Training

FINANCE TRAINING

Building In-house Knowledge and Skills

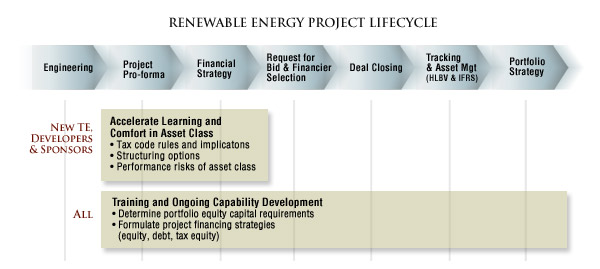

Advantage tax equity financing solutions involve a combination of Analytic Services, Project Finance Training and Modeling Technology tailored to meet client specific needs. Training is a critical component to project success as it establishes a foundation of knowledge required for effective communication, collaboration and decision-making. Training is also provided to build in-house deal execution and modeling capabilities. With both options, financing efforts become more efficient as third party resources can be managed more effectively. Advantage is uniquely committed as an advisor to transfer knowledge and build these capabilities within our clients.

Advantage designs programs that meet specific needs by offering a range of introductory, business and technical tracks. Training is highly interactive and hands-on, providing participants the opportunity to understand and employ skills real-time. Examples include:

Introductory:

Partnerships and Leases: Introduction to Tax Equity Financing

Participants are educated on the fundamentals of financing renewable energy projects using tax equity. Upon completion of the seminar, participants will understand:

1. The relevance of tax equity

2. Similarities and differences between leases and partnerships

3. The perspectives of counterparties in partnerships vs. leases

4. The relevance of: Tax credits, accelerated depreciation, and tax code covenants defining and limiting leases and partnerships

Business:

Business Partnerships and Leases: Understanding the Value Drivers

Participants learn the business implications of using different tax equity structures. Upon completion of the seminar, participants will understand:

1. The financing lifecycle (construction vs. term financing)

2. The relevance of tax equity

3. Similarities and differences between leases and partnerships

4. The perspectives of counterparties in partnerships vs. leases

5. The relevance of: Tax credits, accelerated depreciation, and tax code covenants defining and limiting leases and partnerships

Technical:

Partnership Structuring

Particpants are taught how to structure partnerships and understand the economic effects of different choices. The training provides guidance in structural choices to achieve financial objectives. Example topics include:

1. Trade-offs between different objectives and structuring choices

2. Impact of higher tax investor yield on capital account capacity

3. Limits of tax basis on utilization of DROs

4. Impact of flip term on ability to wind down DROs

5. Impact of minimum gain chargeback on post-flip shares

6. Negative impact on accounting earnings at flip in shares

Lease Pricing

Participants are educated in pricing leases and understanding the economic effects of different choices. Supporting examples are based on Advantage reports.

Partnership Tracking and Accounting

Participants learn the requirements and mechanics for partnership tracking. Upon completion, participants will be able to implement a tracking model. This course draws upon reports provided by the Advantage software, but does not assume that users have the software; participants will be able to apply tracking principles to their own spreadsheet models.